Latest Tariff Exemptions Leave Drones Exposed

The Trump administration announced exemptions for certain Chinese-made electronics from its steep 125% reciprocal tariffs, offering relief to products like smartphones, laptops, and semiconductors, reports Reuters. However, drones, including those from market leader DJI, remain subject to a cumulative 170% tariff, as confirmed by U.S. Customs and Border Protection guidance. This exclusion significantly impacts U.S. consumers, with popular models like the DJI Mavic 3 Pro potentially jumping from $2,199 to $4,750. For DroneXL’s audience of professional and recreational pilots, understanding this policy’s implications, its historical roots, and future outlook is essential.

Historical Tariff Context: A Growing Burden Since 2018

The 170% tariff on Chinese drones reflects a layered history of U.S. trade measures. During Trump’s first term, a 25% tariff on $200 billion of Chinese goods, including drones, was imposed in September 2018 under Section 301 of the Trade Act of 1974, targeting unfair trade practices. This tariff, applied to drones under Harmonized Tariff Schedule code 8525.80.3010, persisted through the Biden administration and remains in effect, as confirmed by the U.S. Trade Representative’s 2024 review.

In Trump’s second term, additional tariffs escalated the burden. On February 4, 2025, a 10% tariff on Chinese imports was enacted via Executive Order 14195, followed by another 10% on March 4, totaling a 20% fentanyl-related tariff. Combined with the 25% Section 301 tariff, this brought the total to 45% by early March. On April 9, 2025, Trump added a 125% reciprocal tariff, resulting in a cumulative 170% tariff on Chinese drones (25% + 20% + 125%). While the April 12 exemptions spared smartphones and laptops, drones were notably excluded, leaving them vulnerable to the full tariff impact, as reported by NPR.

Why Drones Missed the Exemption List

The exemptions for smartphones, laptops, and semiconductors reflect the Trump administration’s awareness of consumer backlash, as analysts warned that steep tariffs on Chinese imports could push a top-end iPhone’s price from $1,599 to $2,300. Drones, however, lack the same broad consumer base and political leverage.

White House deputy press secretary Kush Desai stated, “Trump has made it clear America cannot rely on China to manufacture critical technologies,” signaling a focus on reducing dependence on Chinese tech. Yet, drones face additional scrutiny due to national security concerns, with the U.S. Department of Defense banning DJI drones in 2024 over cybersecurity risks. This may have contributed to their exclusion from the exemptions, prioritizing security over consumer cost relief.

Price Impact on DJI Drones: A Steep Climb

The 170% tariff means the importer now pays 2.7 times the original import price for a DJI drone (1 + 1.7 = 2.7). Before this, with just the 25% tariff, they paid 1.25 times the import price (1 + 0.25 = 1.25). To find the impact on retail price, we divide the new cost by the old cost: 2.7 ÷ 1.25 = 2.16, meaning the total cost to the importer increases by a factor of 2.16. Assuming full cost pass-through and profit margins staying the same, the retail price also rises by this factor, so a drone that was $1,000 at retail now costs $2,160.

Using the current retail prices from the DJI Store:

- DJI Mavic 3 Pro: Current retail price $2,199. New price = $2,199 × 2.16 = $4,749.84, rounded to $4,750.

- DJI Air 3S: Current retail price $1,099. New price = $1,099 × 2.16 = $2,373.84, rounded to $2,374.

- DJI Mini 4 Pro: Current retail price $759. New price = $759 × 2.16 = $1,639.44, rounded to $1,639.

While DJI might absorb some costs, historical trends suggest importers often pass on most tariff burdens, as Amazon CEO Andy Jassy noted regarding third-party sellers.

Market Shifts: Alternatives and Challenges Ahead

The exclusion of drones from tariff exemptions creates immediate challenges for U.S. consumers. Recreational pilots may find new DJI drones prohibitively expensive, potentially slowing the growth of hobbyist communities. Professionals using drones for aerial surveying, cinematography, or agriculture face higher costs, which could limit investments in cutting-edge equipment.

A secondary market for used DJI drones may flourish as consumers seek older models like the Mavic Air 2 to avoid the price hikes.

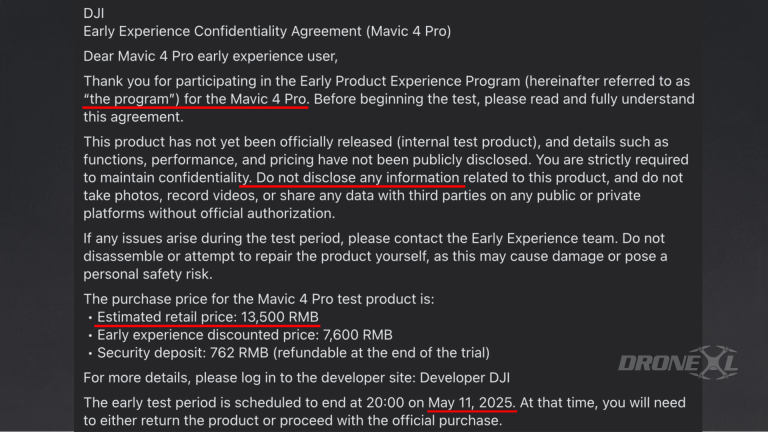

Domestic manufacturers like Skydio could gain traction, as their U.S.-made drones, that still contain Chinese-made parts, avoid some of these tariffs. However, Skydio’s ability to scale production and match DJI’s features—such as AI-power subject recognitions and payload capabilities—remains uncertain, potentially delaying a significant market shift.

Regulatory Outlook: Uncertainty and Opportunities

The tariff policy ties into broader U.S. efforts to decouple from Chinese technology amid security concerns. The CBP guidance offers no exemptions for drone components, suggesting a firm stance, though future waivers could emerge if domestic production lags.

Trade negotiations with China, ongoing since 2018, might eventually reduce tariffs, but Trump’s focus on domestic manufacturing makes near-term relief unlikely. China’s retaliatory 125% tariffs on U.S. goods, effective April 12, 2025, could further disrupt global supply chains, potentially raising costs for drone components like batteries and propellers for U.S. based manufacturers such as Skydio.

DroneXL’s Take: Navigating the New Reality

DroneXL acknowledges DJI’s unmatched capabilities, availability, and relative affordability, setting the standard for both professionals and hobbyists. Yet, an 86% price increase forces tough decisions. Professionals might explore leasing options or shared ownership to manage costs, while hobbyists could consider domestic alternatives like Skydio or second-hand DJI or Autel Robotics models. The tariff’s retroactive exemption for goods shipped by April 5, 2025, offers a brief window for savvy buyers to purchase at pre-tariff prices, but that window has likely closed for most.

Looking ahead, DroneXL advises staying informed about policy shifts. Tariffs can change quickly with new administrations or trade agreements, and a future reduction could ease the burden. For now, diversifying options—whether through domestic brands or older DJI models—provides the best path forward. Current DJI owners should rest easy; their existing drones remain unaffected, but future purchases require careful planning in this high-cost environment.

The 170% tariff on Chinese drones marks a pivotal moment for U.S. consumers. Building on tariffs from 2018, this policy significantly raises the cost of DJI drones, challenging both recreational and professional users. While domestic manufacturers may seize the opportunity, their ability to rival DJI’s technology remains uncertain. As the market adapts, DroneXL’s audience must weigh cost against performance, exploring alternatives and staying vigilant for policy changes that could reshape the drone landscape in 2025 and beyond.

Featured photo courtesy of Drone Supremacy.

Discover more from DroneXL.co

Subscribe to get the latest posts sent to your email.

+ There are no comments

Add yours