North Dakota is poised to solidify its leadership in the Drone Industry with a newly approved $11 million appropriation aimed at integrating its Vantis unmanned aerial system (UAS) with the Federal Aviation Administration’s (FAA) Pathfinder radar program. This development, detailed in a recent article by the North Dakota Monitor, promises to expand commercial drone applications across the state while navigating a contentious debate over replacing Chinese-made drones.

A Leap Forward for Commercial Drone Operations

The integration of the Grand Forks-based Northern Plains UAS Test Site‘s Vantis radar platform with FAA systems marks a significant milestone. Currently, Vantis covers 3,000 square miles, but this upgrade will extend its reach to 56,000 square miles—encompassing most of North Dakota, as shown in a map from the Northern Plains UAS Test Site included in the original report. This expansion shifts the paradigm from traditional line-of-sight operations, where pilots must visually track drones, to beyond visual line of sight (BVLOS) capabilities, a critical advancement in drone technology.

Frank Matus, director at Thales USA and chairman of the North Dakota UAS Council, emphasized the groundbreaking nature of this move. “It’s the first time the federal government has done something like this,” he said, crediting the maturity of Vantis infrastructure. This collaboration will demonstrate to the FAA how drones can safely integrate into national airspace, potentially setting a precedent for other states.

For businesses, the implications are substantial. Agricultural spraying, pipeline monitoring, and emergency response—already in use—could scale up significantly. Erin Roesler, deputy executive director of the Northern Plains UAS Test Site, highlighted practical examples: assisting power cooperatives during 2023 ice storms and supporting flood response efforts in eastern North Dakota. Looking ahead, rural delivery services, such as medical supplies or even commercial packages from companies like Amazon, could become viable, enhancing quality of life in remote areas—an area of growing interest in drone delivery.

Economic and Infrastructure Advantages

The $11 million investment, part of House Bill 1038 finalized on February 20, 2025, offers both immediate and long-term benefits. By pioneering this infrastructure, North Dakota positions itself to license the model to other regions, generating royalties, according to Roesler. She also noted cost savings: integrating later could have cost the state $255 million—over 23 times the current appropriation, a figure verified in the source material.

Matt Dunlevy, CEO of Grand Forks-based Aethero, underscored the economic potential. His company, which uses drones for building analysis, sees BVLOS as “the holy grail of drone ops.” Expanded coverage could transform industries like agriculture and oil and gas by improving management and maintenance efficiency. “We’ve been handed this huge success,” Dunlevy said, urging the state to capitalize on it. This aligns with broader trends in commercial drone applications.

The Stalled Drone Replacement Debate

House Bill 1038 initially included a $15 million plan to replace approximately 300 Chinese-made drones—primarily from DJI—used by state agencies and universities. These drones, constituting nearly 90% of the state’s fleet according to the source, raised security concerns due to potential data vulnerabilities flagged by the U.S. Department of Defense and federal laws like the National Defense Authorization Act (NDAA) and the American Security Drone Act of 2023.

Rep. Mike Nathe, R-Bismarck, the bill’s sponsor, argued for proactive replacement, citing risks over sensitive areas like oil fields and military sites. However, the Senate rejected this provision on February 14, 2025, favoring cost and functionality concerns. DJI drones, priced around $7,500 (e.g., the Matrice 30), are significantly cheaper and more user-friendly than NDAA-compliant alternatives from U.S. manufacturers like Teal or Skydio, which range from $20,000 to $50,000, per industry estimates.

Opposition came from voices like Russell Gust, a Minot-based drone operator and educator, who called the $50,000-per-drone replacement cost “egregious.” Gust acknowledged the looming federal ban but argued that a sudden shift would strain supply chains, given DJI’s dominance and the limited U.S. drone market. DJI defends its security, citing independent audits showing no unauthorized data transmission in Local Data Mode, though skepticism persists due to China‘s state secrets laws.

Regulatory and Market Implications

The rejection of the replacement funds doesn’t halt Vantis integration, but it complicates state agency operations. NDAA-compliant drones are required for the Vantis network, meaning noncompliant DJI units can’t leverage the expanded system. Roesler warned that a federal ban, expected by late 2025, will force compliance regardless, leaving agencies to scramble without a structured transition plan—a concern echoed in drone regulations discussions.

This tension reflects broader industry challenges. China’s DJI reportedly benefits from robust government support and supply chains, outpacing U.S. development. A phased ban, as Gust predicts, might mitigate disruption, but the lack of affordable, high-quality American alternatives remains a bottleneck. North Dakota’s experience could influence national policy, especially as other states face similar dilemmas.

A Dual-Edged Opportunity

North Dakota’s $11 million investment secures its role as a drone innovation hub, promising economic growth and enhanced services. Yet, the unresolved replacement debate underscores a critical vulnerability. As federal restrictions tighten, the state must balance security with practicality—a challenge mirrored across the U.S. drone sector.

The Vantis expansion could redefine commercial drone use, from precision agriculture to rural logistics, while testing the FAA’s airspace integration framework. However, without a clear path to replace restricted drones, North Dakota risks operational gaps. Nathe remains optimistic, expecting the replacement issue to resurface later in the session. For now, the state stands at a crossroads, leveraging its first-mover advantage while grappling with global supply chain realities.

DroneXL’s Take

North Dakota’s bold step forward with Vantis is a win for BVLOS advocates, but the DJI debate highlights a glaring gap in U.S. drone policy. The industry needs domestic manufacturers to step up with cost-competitive, reliable options—fast. Until then, states like North Dakota will remain caught between innovation and compliance, a tension that could shape the future of American UAS leadership.

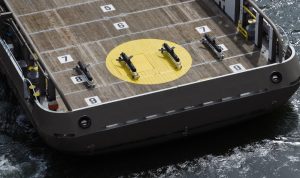

Photo courtesy of Vantis

Discover more from DroneXL.co

Subscribe to get the latest posts sent to your email.

+ There are no comments

Add yours