In Dublin’s Blanchardstown suburb, drones hum steadily above, delivering coffee and pizza in under 16 minutes—a glimpse into a future where instant, autonomous delivery could reshape retail. Manna Aero, a Dublin-based startup, has logged 200,000 flights, outpacing giants like Amazon and Alphabet’s Wing in suburban skies. Founder Bobby Healy claims drones are “an Amazon slayer,” but scaling this model faces regulatory, financial, and public hurdles, reports The Guardian.

A Suburban Delivery Breakthrough

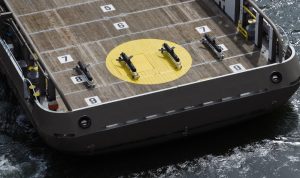

Manna’s drones take off from compact bases, rising to 70 feet (21 meters) before zipping to deliver within a 2.1-mile (3.4-km) radius. Each quadcopter, weighing 51 pounds (23 kg) with a 9-pound (4-kg) payload, can handle four 15-inch pizzas or several books. A single operator oversees up to 20 drones, enabling 80 deliveries daily per aircraft—double a typical driver’s output.

“In suburbs, that delivery driver thing is a broken model,” Healy told The Guardian. “There’s no way you can get a delivery driver to do that and make it profitable.”

The process is nearly fully autonomous. Drones navigate independently after takeoff, with pilots intervening only to verify clear drop zones via video. Deliveries average six minutes from base to garden, dropping packages on biodegradable strings. A test saw two coffees arrive unspilled in 16 minutes, compared to 11 minutes minimum for an e-bike courier.

Manna’s efficiency stems from low energy use and streamlined operations. Bases, fitting two shipping containers and five 6.6-foot-square (2-m²) landing zones, serve 150,000 people in Blanchardstown. By year-end, Manna aims to cover 1 million Dubliners, excluding dense city centers where gardens are scarce.

Technical Edge and Reliability

Designed in Dublin and Wales, Manna’s drones use aerospace-grade parts, mostly from China. Eight motors ensure redundancy; a drone can fly on four if needed. An inbuilt parachute, used once in 200,000 flights, underscores safety. The European Union Aviation Safety Agency (EASA) has audited Manna’s tech, affirming compliance. Batteries swap out post-flight, maintaining rapid turnaround.

Payload constraints reveal practical limits. While 9 pounds covers most orders, volume can be trickier. Healy recalled a Finnish order of 24 toilet rolls split into two deliveries due to space. “Must have been an emergency,” he quipped. Such anecdotes highlight drones’ niche: urgent, small-scale suburban deliveries.

Expansion Ambitions and Regulatory Realities

Manna’s Dublin success—200,000 flights and partnerships with Just Eat and DoorDash—fuels bold plans. Healy eyes 2 million annual flights by 2025’s end, targeting most of Dublin’s suburbs. Helsinki operations prove the model works in varied climates, but the UK is the next frontier. EU drone standards, adopted April 1, 2025, could enable a UK launch this year or by 2026. Healy promises free deliveries for UK customers, with businesses paying commissions instead of Ireland‘s $2.10 (€1.99) fee.

Regulation remains a choke point. The UK’s Civil Aviation Authority lags behind EASA, delaying Manna’s entry. Healy’s optimism—“definitely 2026”—betrays uncertainty. Amazon’s stalled UK warehouse trials and Wing’s Australian backlash show regulatory and public skepticism can derail progress. Manna’s low-profile approach helps; Healy notes Dubliners rarely “look up” at buzzing drones, suggesting acceptance through familiarity.

Financial and Competitive Landscape

Manna operates leanly, raising $64 million (€60 million) from investors like Coca-Cola and Stripe’s Patrick Collison. Each flight is profitable, but expansion costs loom. Scaling to 1 million people and millions of flights demands infrastructure—more bases, drones, and staff. Healy’s frugal ethos contrasts with Amazon and Alphabet’s deep pockets, yet he sees opportunity: “If you can move everything in three minutes, then you have an Amazon slayer.”

Competition is fierce. Amazon delivers in Texas, Arizona, and Italy, while Wing operates globally. Zipline excels in medical logistics. Manna’s edge lies in suburban focus and operational scale—200,000 flights dwarf early trials by rivals. Partnerships with Just Eat and DoorDash broaden its reach, integrating drones into existing platforms. Still, Healy acknowledges risks: “People will balk at instant retail gratification.” Public pushback, as seen in Australia, could intensify with scale.

Industry Implications

Drone delivery’s promise—bypassing traffic, cutting emissions—faces scrutiny. Manna’s drones emit up to eight times less CO2 than cars, per a Maynooth University study, aligning with sustainability goals. Yet, scaling introduces complexities. Airspace congestion, noise complaints, and Wildlife impacts linger as concerns. Healy claims birds avoid drones, but rival operators could complicate navigation.

For retailers, drones enable hyper-local commerce. Restaurants, bookstores, and tool shops gain reach without logistics overhead. Healy envisions “a totally different form of commerce,” empowering small businesses to rival e-commerce giants. However, urban limitations—flats lack drop zones—restrict drones to suburbs, leaving city markets to couriers.

DroneXL’s Take

Manna’s traction in Dublin and Helsinki signals drones are no longer futuristic—they’re here, delivering coffee faster than e-bikes. For DroneXL readers, from professionals to hobbyists, Manna’s tech showcases what’s possible: robust, redundant drones scaling to millions of flights. Yet, Healy’s “Amazon slayer” boast invites skepticism. Regulatory delays and public perception could stall progress, especially in the UK. Professionals should note Manna’s operator model—20 drones per pilot—as a benchmark for efficiency, while recreational pilots might see inspiration in its safety-first design. The real test lies ahead: can Manna sustain profitability and public goodwill as it scales? If it falters, deeper-pocketed rivals won’t hesitate to swoop in.

Photo courtesy of Patrick Bolger / The Guardian.

Discover more from DroneXL.co

Subscribe to get the latest posts sent to your email.

+ There are no comments

Add yours