Hidden Level Inc., a Syracuse-based drone defense startup, has raised approximately $100 million across two funding rounds led by Lockheed Martin Ventures and DFJ Growth, achieving a valuation of nearly $500 million. The company, which specializes in passive radar systems for drone detection and tracking, also secured a significant 10-year contract with the US Army in 2024.

Technical Capabilities and Infrastructure

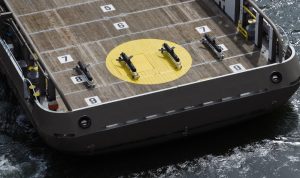

Hidden Level’s core technology revolves around passive radar systems that can detect and track drones and other aerial objects without emitting detectable signals. This approach offers significant advantages over traditional active radar systems through its covert operation capabilities, ensuring the system remains undetectable while monitoring airspace. The technology provides wide-area coverage while maintaining continuous real-time tracking of multiple aerial objects simultaneously. The company has developed ruggedized hardware units specifically designed to withstand battlefield conditions, complemented by comprehensive software services for threat analysis, creating an integrated airspace security solution.

Market Position and Growth

Hidden Level’s financial trajectory shows remarkable progress, with revenue reaching $5 million in 2024 and projections indicating a substantial increase to $25 million in 2025, representing a 400% growth rate. The company’s current revenue stream is predominantly driven by government sales, accounting for 80% of income, while commercial applications contribute the remaining 20%, presenting significant potential for future expansion. As part of its growth strategy, Hidden Level plans to expand its workforce from the current 100 employees to 160 within the next 18 months, with a particular emphasis on scaling manufacturing capabilities for its newest hardware units.

Industry Context and Significance

This funding round reflects the growing importance of counter-Drone Technology in both military and civilian applications. Recent incidents, including an attempted attack on an energy substation in Tennessee, highlight the increasing threat posed by commercially available drones. The involvement of Lockheed Martin Ventures signals strong confidence in Hidden Level’s technology from a major defense contractor. DFJ Growth Partner Randy Glein, who led early investments in SpaceX, draws parallels between Hidden Level and other successful government contractors, citing increasing adoption by military customers.

Regulatory and Market Implications

Hidden Level’s passive radar technology addresses critical concerns in the current regulatory environment through its compliance with military electromagnetic emissions standards and non-interference with civilian aviation systems. The technology’s scalable deployment options make it suitable for various security scenarios. The company’s $100 million funding round represents one of the larger investments in drone defense technology, highlighting the sector’s growing importance in national security infrastructure.

Future Outlook

Hidden Level’s expansion plans and recent Army contract position it as a significant player in the evolving drone defense landscape. The company’s focus on passive detection technology offers a unique approach to addressing emerging security challenges, particularly as drone threats become more sophisticated. The substantial funding round and high-profile investors suggest growing confidence in specialized drone defense solutions, especially those offering covert detection capabilities. As global security concerns continue to evolve, Hidden Level’s technology could play an increasingly important role in both military and civilian infrastructure protection.

Discover more from DroneXL.co

Subscribe to get the latest posts sent to your email.

+ There are no comments

Add yours