Red Cat Holdings, a key player in Drone Technology, has secured $46.75 million through a registered direct offering of 6,448,276 shares to institutional investors, reports Stock Titans. The deal, set to close around June 18, 2025, will fuel the company’s expansion into unmanned surface vessels (USVs), broadening its offerings for military, government, and commercial clients beyond aerial drones.

New Maritime Drone Division

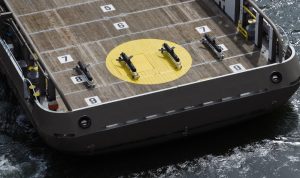

Red Cat is venturing into maritime robotics with a dedicated USV division, focusing on autonomous boats for tasks like surveillance, reconnaissance, and logistics. The company will use part of the $46.75 million to cover operating costs for this division, tapping into a growing market where USVs are valued for their ability to perform high-risk missions without human crews. This complements Red Cat’s aerial systems, such as the Black Widow™, a compact ISR drone selected for the U.S. Army’s Short Range Reconnaissance Program, and the FANG™, an NDAA-compliant FPV drone with precision strike capabilities.

The USV market is gaining traction, driven by demand for cost-effective solutions in defense and commercial sectors, such as port security and offshore energy inspections. Red Cat’s “Family of Systems” approach—integrating aerial and maritime platforms—aims to deliver seamless, multi-domain solutions, enhancing operational efficiency for users.

Financial Impact and Trade-Offs

The $46.75 million infusion strengthens Red Cat’s balance sheet, enabling investment in USV development and broader operations. Northland Capital Markets, the exclusive placement agent, executed the offering under an SEC-effective shelf registration statement, streamlining the process.

Red Cat stated, “The Company intends to use net proceeds from the offering for general corporate and working capital purposes, including but not limited to operating expenditures related to its new unmanned surface vessel division.”

However, the issuance of over 6.4 million new shares dilutes existing shareholders’ stakes, which could pressure stock value. Offering costs and agent fees will also reduce net proceeds, though exact figures remain undisclosed.

Institutional investors’ involvement signals market confidence in Red Cat’s strategy, particularly its pivot toward maritime drones. Yet, the vague allocation of funds beyond USV expenses may leave investors wanting more clarity on other priorities, such as scaling existing drone production or software enhancements.

Benefits for Drone Professionals

Red Cat’s expansion into USVs reflects a broader industry shift toward integrated autonomous systems. For drone professionals and enthusiasts, this could mean access to advanced, interoperable technologies that combine aerial and maritime capabilities, potentially reducing costs through shared R&D. The company’s focus on NDAA-compliant systems also ensures compatibility with U.S. regulatory standards, a key consideration for government contracts.

With the offering closing around June 18, 2025, Red Cat is poised to accelerate its maritime drone ambitions, balancing growth opportunities with the challenges of dilution and operational scaling. This move positions the company as a versatile leader in the evolving drone technology landscape.

Photo courtesy of Red Cat Holdings.

Discover more from DroneXL.co

Subscribe to get the latest posts sent to your email.

+ There are no comments

Add yours