Taiwan’s Drone Industry is accelerating its bid to become a global powerhouse, capitalizing on its semiconductor prowess and a strategic pivot away from Chinese supply chains. This transformation, fueled by a $1.35 billion government investment and international partnerships, positions Taiwan as a vital alternative in a market long dominated by China‘s DJI. As reported earlier by DroneXL, this shift reflects both geopolitical necessity and technological ambition, with implications for commercial and military applications worldwide.

A Strategic Leap from Chinese Dependence

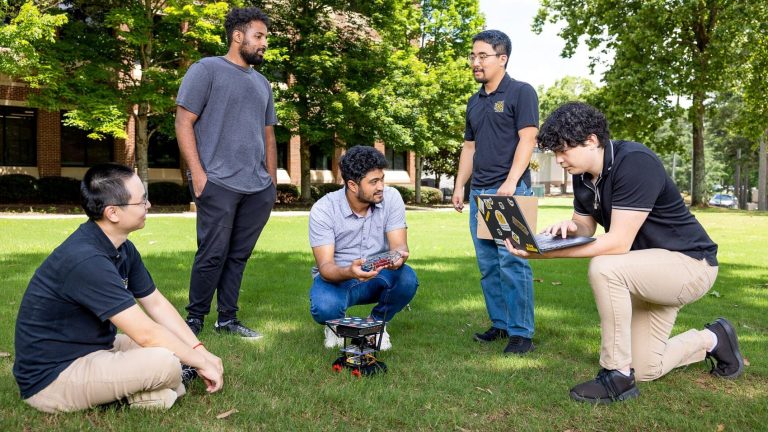

Taiwan’s push to establish a “non-red” supply chain—free of Chinese components—stems from escalating tensions across the Taiwan Strait and global concerns over supply chain security. The Taiwan Excellence Drone International Business Opportunities Alliance (TEDIBOA), spearheaded by Aerospace Industrial Development Corporation (AIDC), unites over 50 local firms to streamline production and innovation. This effort aligns with a broader international trend, as nations like the U.S. seek reliable alternatives to Chinese technology amid trade restrictions and security risks.

The government’s four-year, $1.35 billion investment targets research and development, focusing on critical drone components such as chips, sensors, and software. Taiwan’s edge lies in its semiconductor industry, a global leader producing advanced chips for navigation, communication, and AI-driven drone functions. Companies like Thunder Tiger Corporation and Geosat Aerospace & Technology are already leveraging this expertise to craft competitive, proprietary technologies.

Building a Drone Ecosystem in Chiayi County

Chiayi County has emerged as Taiwan’s drone development hub, hosting the Asia UAV Innovation Center and Minxiong Aerospace Industrial Park. These facilities foster collaboration among manufacturers, researchers, and regulators, creating a clustered ecosystem designed to accelerate innovation. Streamlined regulations for testing and development further bolster this environment, allowing firms to iterate quickly and bring products to market.

This industrial focus isn’t just about hardware. Specialized Education programs are training a new generation of engineers and technicians, addressing skill shortages that could hinder growth. Together, these efforts aim to transform Taiwan into a self-sufficient drone production powerhouse.

Global Partnerships Fuel Expansion

Taiwan’s ambitions extend beyond its borders through strategic international alliances. Memoranda of Understanding (MOUs) with the U.S., Latvia, Poland, and Lithuania enhance technological collaboration and open new markets. The U.S.-Taiwan partnership, in particular, emphasizes dual-use drones—systems viable for both civilian and military purposes—that adhere to NATO-aligned standards for secure navigation and encrypted communication.

These partnerships come at a critical time. Foreign firms, wary of China’s dominance and seeking dependable suppliers, are increasingly turning to Taiwan. TEDIBOA’s upcoming announcements, slated for mid-May 2025, are expected to unveil further integration opportunities, signaling Taiwan’s intent to cement its global presence.

Military Drones: A Geopolitical Game-Changer

Cross-strait tensions with China have thrust military applications into the spotlight. Taiwan’s drones are integral to its asymmetric warfare strategy, designed to counter larger adversaries with agile, tech-driven solutions. The U.S.-Taiwan collaboration is producing secure UAVs and satellite systems, reducing reliance on Chinese components while enhancing interoperability with Western militaries.

This focus isn’t speculative. As The Diplomat notes, Taiwan’s military drone capabilities are evolving rapidly, with an emphasis on resilience and adaptability in contested environments.

Challenges on the Horizon

Despite its momentum, Taiwan’s drone industry faces significant obstacles. Cost competitiveness is a glaring issue—Taiwanese components often carry a higher price tag than their Chinese counterparts, potentially limiting market share. Scaling production to meet global demand also remains a hurdle, as infrastructure and manufacturing capacity lag behind ambitions.

China’s DJI, holding a 70% share of the global drone market, looms large. Its economies of scale and established distribution networks present a formidable barrier to Taiwan’s ascent. Overcoming these challenges will require not just innovation but also savvy market strategies and sustained government support.

Market Implications and Industry Context

Taiwan’s rise comes amid a seismic shift in the drone industry. China’s dominance—bolstered by DJI’s affordable, feature-rich offerings—has long shaped the market. Yet, security concerns and U.S. sanctions, such as those targeting Chinese drone firms in early 2025 (DroneXL), are driving demand for non-Chinese alternatives. Taiwan, with its reliable supply chain and advanced tech base, is well-positioned to capitalize.

Commercially, this shift benefits sectors like agriculture, logistics, and infrastructure inspection, where drones are increasingly indispensable. Militarily, it strengthens Taiwan’s defense posture while offering NATO-aligned nations secure options. The $1.35 billion investment (approximately 43.2 billion TWD as of April 2025, assuming an exchange rate of 32 TWD to 1 USD) underscores the scale of this opportunity.

Regulatory and Infrastructure Considerations

Regulatory reform is a linchpin of Taiwan’s strategy. Simplified testing protocols and airspace policies are essential to keep pace with innovation, particularly for military and large-scale commercial drones. Infrastructure—such as expanded manufacturing facilities and testing ranges—must also grow to support production targets.

These efforts mirror global trends. As GlobeNewswire reports, nations worldwide are investing in drone ecosystems, with Taiwan’s non-Chinese focus giving it a unique edge.

A Drone Power in the Making

Taiwan’s drone industry stands at a crossroads of opportunity and challenge. Its $1.35 billion investment, semiconductor leadership, and international partnerships signal a bold bid for global relevance. By mid-2025, TEDIBOA’s announcements could solidify this trajectory, positioning Taiwan as a linchpin in a diversified, secure drone supply chain.

The broader impact is clear: as geopolitical tensions reshape technology markets, Taiwan offers a compelling alternative to China’s dominance. Success hinges on overcoming cost and scale barriers, but the foundation—technical expertise, strategic alliances, and government backing—is robust.

DroneXL’s Take

Taiwan’s focus on “non-red” supply chains isn’t just a business move—it’s a geopolitical statement. By blending its chip-making prowess with drone innovation, Taiwan could redefine industry standards. Watch for May 2025; if TEDIBOA delivers, this could mark the moment Taiwan’s drones truly take flight on the world stage.

Photo courtesy of the Taiwan Excellence Drone International Business Opportunities Alliance (Tediboa).

Discover more from DroneXL.co

Subscribe to get the latest posts sent to your email.

+ There are no comments

Add yours