Threod Systems, an Estonian drone manufacturer, is considering a sale to capitalize on the rapid growth in demand for unmanned aircraft driven by the ongoing conflict in Ukraine, according to Bloomberg.

Rapid Revenue Growth and Customer Base

Threod Systems achieved €38 million ($44 million) in sales for 2024, marking an 87% increase from the previous year. This expansion reflects the company’s role in supplying surveillance drones to Ukraine, where they see regular battlefield use, and to seven NATO countries, including the UK, Poland, and Lithuania.

Founded in 2012, Threod employs about 160 people and produces fixed-wing drones, vertical takeoff and landing (VTOL) models, and supporting systems like launchers and optics. The company has also engineered small electro-optical payloads, known as gimbals, equipped with laser designators. These components mount on various drone types and enable precise threat identification and targeting.

Chief Executive Officer Arno Vaik stated in a November 2024 interview that the company aims to reach €100 million in revenue within a few years. This ambition aligns with Threod’s current trajectory, as advisers gauge interest from potential buyers, including major European defense firms and private equity groups.

Broader Geopolitical and Industry Trends

Investor enthusiasm for European defense startups has intensified amid shifting geopolitical dynamics and extensive rearmament efforts across the continent. European nations face pressures from Russian President Vladimir Putin and US President Donald Trump, prompting preparations to allocate trillions of euros to defense. In June, NATO members committed to raising defense spending to 5% of gross domestic product, following Trump’s criticisms of allies’ security contributions.

Drones offer a cost-effective alternative to traditional missiles and have proliferated in the Ukraine war, aiding Kyiv against a superior adversary. Russia has escalated its use of long-range unmanned aerial vehicles (UAVs), deploying large barrages after Ukrainian drone strikes on its air bases in June. This development has spurred NATO members to increase UAV investments, challenging China’s historical dominance in the sector.

Implications for Drone Technology and Market Dynamics

Threod’s potential sale highlights opportunities for consolidation in the drone industry, where technical advancements in surveillance and targeting systems draw significant attention. The integration of laser-equipped gimbals enhances operational precision, allowing drones to support reconnaissance and strike missions effectively. This raises questions about how such technologies might evolve under new ownership, potentially accelerating innovation in VTOL and fixed-wing designs.

Building on that, several drone companies are securing funding or eyeing public offerings. For instance, Destinus SA, which supplies weapons to Ukraine, is negotiating funding at a valuation up to €1.5 billion. Tekever Ltd. recently raised capital at over £1 billion ($1.4 billion) after securing a Royal Air Force contract. German firm Quantum Systems Pte Ltd., backed by Peter Thiel, obtained €160 million in May from investors like Balderton Capital, Airbus-linked entities, and Porsche SE.

These trends suggest a maturing market where European manufacturers gain ground, driven by regulatory shifts toward higher defense budgets and a focus on domestically produced UAVs. For drone professionals, this could mean expanded access to advanced systems, though economic implications include rising costs amid increased demand. Regulatory changes, such as NATO’s spending targets, may further influence procurement strategies, favoring reliable suppliers like Threod.

The evolving landscape underscores the strategic importance of drones in modern warfare, with implications extending to recreational pilots through potential trickle-down innovations in optics and launch systems. However, the sector must navigate geopolitical risks, including supply chain dependencies and international tariffs.

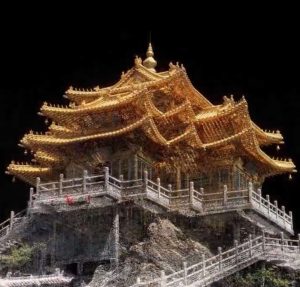

Photos courtesy of Threod Systems

Discover more from DroneXL.co

Subscribe to get the latest posts sent to your email.

+ There are no comments

Add yours