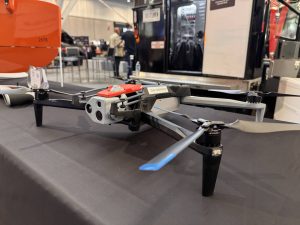

In a striking revelation from Danish television network TV 2, at least 71 municipalities across Denmark are operating a fleet of 223 drones manufactured by Chinese firm Da Jiang Innovations (DJI), a company blacklisted by U.S. authorities over national security concerns. While drones have become indispensable tools for tasks ranging from environmental monitoring to infrastructure inspection, this reliance on Chinese technology is raising eyebrows amid escalating global cybersecurity tensions.

Why the U.S. Blacklisted DJI

DJI, based in Shenzhen, commands over 70% of the global commercial drone market, thanks to its affordable pricing and advanced technology. Models like the DJI Mavic 3 and DJI Matrice 300 offer features such as 4K video, thermal imaging, and flight ranges exceeding 9 miles—specifications that outpace many competitors. Yet, the FBI and U.S. Department of Defense have flagged these drones as potential vectors for data leakage to the Chinese government. A joint statement from CISA and the FBI warns that Chinese-manufactured unmanned aircraft systems (UAS) “risk exposing sensitive information that jeopardizes U.S. national security.”

The U.S. ban on DJI products across federal agencies stems from China‘s 2017 National Intelligence Law, which mandates companies to cooperate with state intelligence efforts. This, coupled with Beijing’s 2021 data protection laws, fuels fears that drones operating over critical infrastructure could transmit sensitive telemetry—such as GPS coordinates or video feeds—back to PRC authorities.

Denmark’s Pragmatic Approach to DJI Drones

Despite these warnings, Danish Police, military, and municipal authorities show no signs of grounding their DJI fleets. Andreas Bøje Forsby, a Danish international relations expert, attributes this to market realities. “DJI drones are cheaper—often costing $1,500 to $15,000 compared to $20,000-plus for alternatives—and they’re technologically superior,” he notes. For cash-strapped municipalities, the choice is less about geopolitics and more about budgets.

Denmark’s 223 DJI drones, deployed across applications like drone inspections and surveillance, reflect a broader trend of reliance on DJI’s ecosystem. The Danish Security and Intelligence Service (PET) acknowledges their use but has not signaled an immediate pivot away from Chinese technology.

Regulatory Winds Shifting?

While Denmark hasn’t mirrored the U.S. ban, cracks in its laissez-faire stance are emerging. Torsten Schack Pedersen, Denmark’s Minister of Public Security and Emergency Preparedness, recently called for caution in deploying Chinese drones. The Danish Ministry of Trade and Industry is also mulling cybersecurity regulations, potentially mandating local data storage to prevent unauthorized access—a move that could align with data security priorities seen elsewhere.

DJI consistently defends its independence from Chinese government influence. In a December 17, 2024, statement, the company asserted, “DJI is a privately held company founded by Frank Wang in 2006,” emphasizing that no government entity controls its operations. Yet, as The Verge reported on February 5, 2025, DJI’s head of public policy, Adam Welsh, confirmed the firm removed geofencing enforcement in the U.S., meaning drones can now fly over sensitive areas like the White House with only a dismissible warning. This shift underscores the limits of manufacturer control, particularly as U.S. ban pressures mount.

Market and Geopolitical Implications

Denmark’s situation underscores a broader dilemma in the drone industry. DJI’s dominance leaves few viable alternatives—drone firms like Autel Robotics or Blue sUAS-approved vendors such as Skydio struggle to match its scale and pricing. For Denmark, replacing 223 drones could cost upwards of $4.4 million (assuming $20,000 per unit), a steep premium over DJI’s $1,500 to $15,000 range.

Globally, this reliance feeds into a cybersecurity cold war. The U.S. pushes allies to ditch Chinese tech, while Europe wavers between economic pragmatism and security alignment. Denmark’s hesitation to act could strain its relationship with NATO partners, particularly as Department of Defense concerns amplify.

DroneXL’s Take

Denmark’s 223 DJI drones buzzing over its municipalities illustrate the tightrope nations walk between technological necessity and geopolitical pressure. As cybersecurity becomes a frontline issue, the drone technology landscape may force tougher choices—whether that’s investing in domestic alternatives or accepting calculated risks. For now, DJI’s wings remain unclipped in Danish skies, but the forecast hints at regulatory turbulence ahead.

This standoff highlights a critical gap in the drone market: the lack of affordable, secure alternatives to DJI. Until that void is filled, expect nations like Denmark to keep flying Chinese hardware—security warnings be damned.

Discover more from DroneXL.co

Subscribe to get the latest posts sent to your email.

+ There are no comments

Add yours